Call/Text George Lorimer for information or to work together. 619-846-1244

Your Home Sold Guaranteed or I'll Buy It!* *Conditions apply

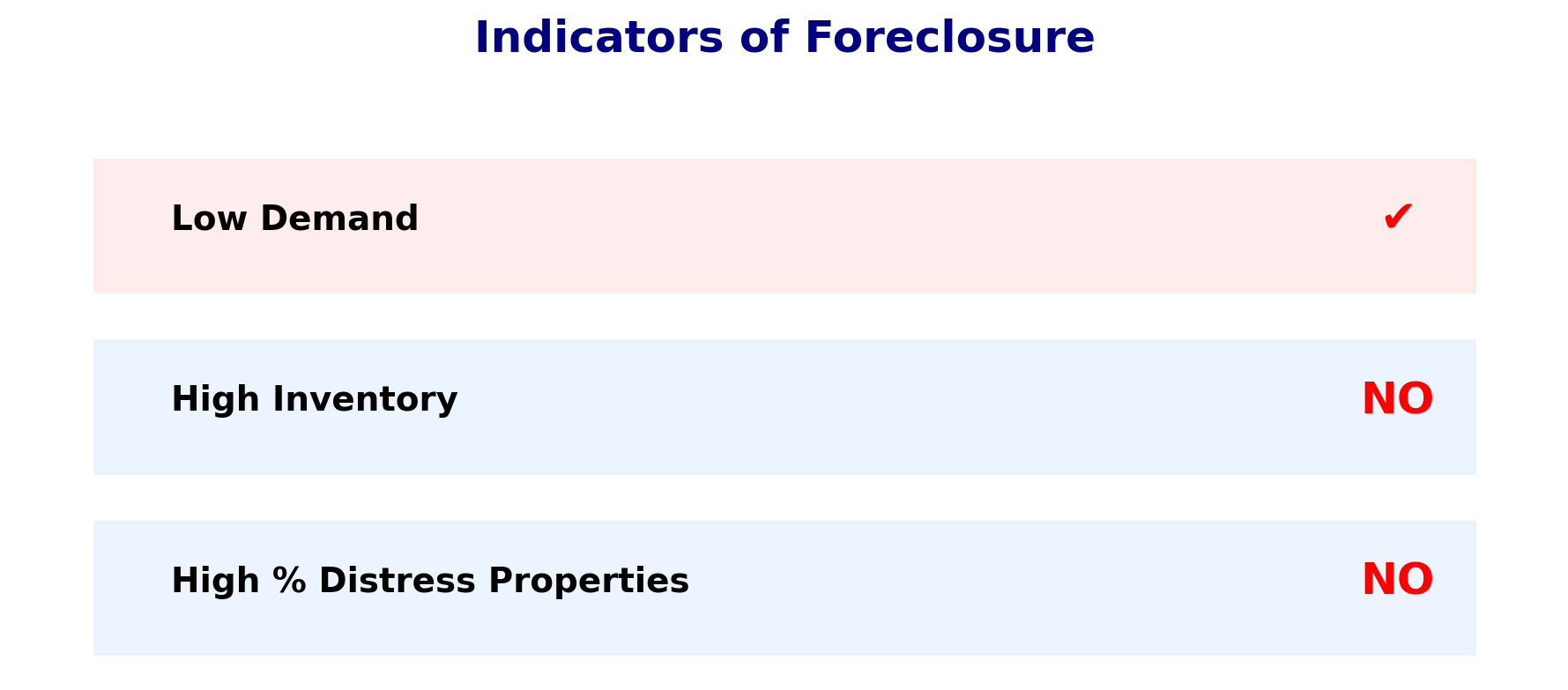

Three Key Indicators of Looming Foreclosures

Homeowners and buyers often ask, “How do we know if foreclosures are coming back?” The answer lies in three leading indicators:

What's Your San Diego Home Worth Today?

1. Low Demand

Right now, demand is below normal. San Diego is seeing about 2,000 home sales per month, when a more balanced market would see closer to 3,000–3,200 sales. This is the one red flag currently flashing—buyers are holding back due to higher mortgage rates.

2. High Inventory

Nationwide inventory sits around 1.55 million homes for sale. To put that in perspective, during the Great Recession, inventory ballooned to 4 million homes. Today’s numbers don’t point to an oversupply problem.

3. High Percentage of Distress Properties

Distressed sales (short sales, foreclosures, etc.) make up less than 1% of the market today. In 2009, they were nearly 45% of all transactions. That massive wave of distressed properties drove prices down back then—something we aren’t seeing in 2025.

Search Homes

The Bottom Line in 2025

Of the three foreclosure warning signs, only low buyer demand is present. And even that may be temporary, as mortgage rates are trending down from September 2025 through the year’s end.

If you’d like a free report on which San Diego ZIP codes are appreciating the most, call or text me directly at 619-846-1244.

George Lorimer

ProWest Properties | DRE #01146839 | *Conditions apply