2026 San Diego Housing Outlook — What Buyers and Sellers Should Know Now

George Lorimer at 619-846-1244

Your Home Sold Guaranteed, or I’ll Buy It!*

|

|

|

A quick reality check for 2026

The most honest outlook for 2026 is this: the market looks relatively flat overall — and there’s no way to predict exactly where prices land in your neighborhood.

Rates are the swing factor. If mortgage rates move from about 6.2% (now) up toward 6.5%+, affordability gets tighter and prices can soften. If rates drop into the 5.5%–5.75% range, demand can heat up fast — and prices can push higher with more competition.

Bottom line: there’s no “sure deal” or perfect timing. If moving now or soon is right for you, we can make it up on the sale or purchase depending on the market conditions at the time. The waiting game rarely works — it’s usually better to move forward and get the best deal for this market.

I’m here to help. Call or text me today to get your free 2026 plan: 619-846-1244.

|

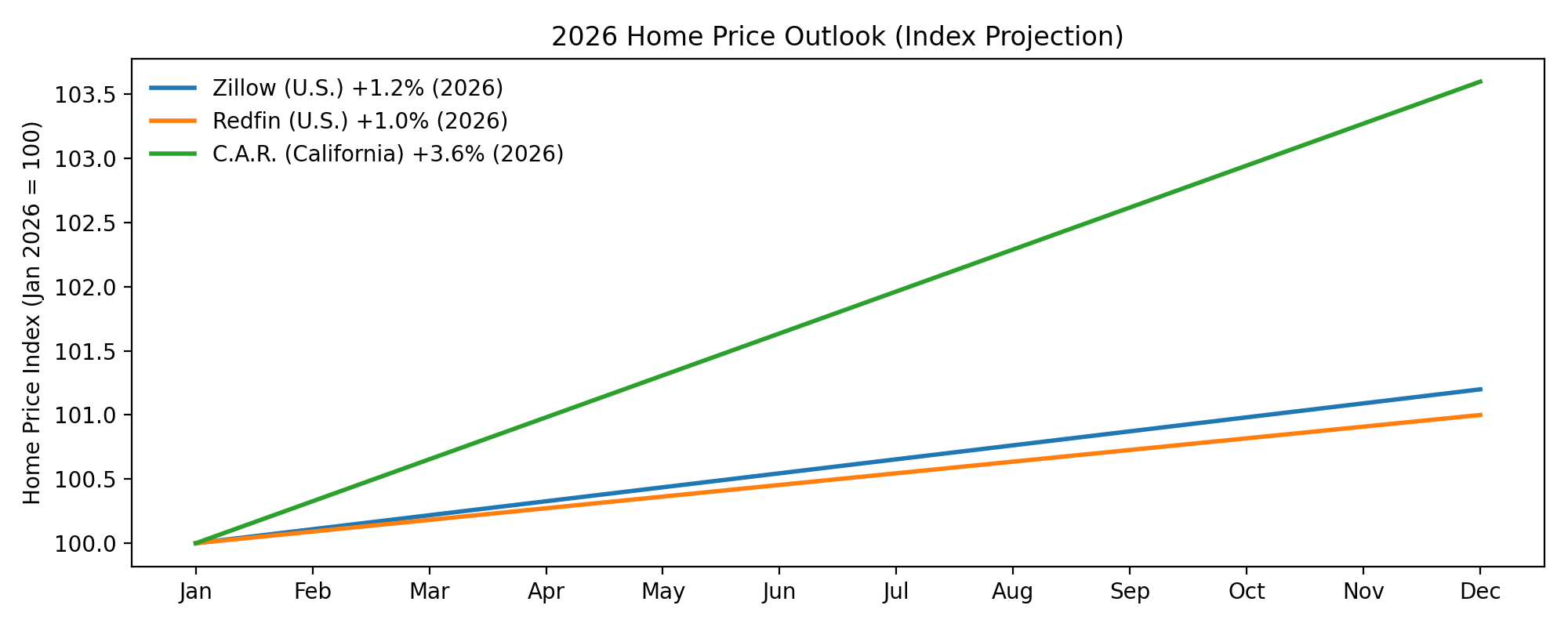

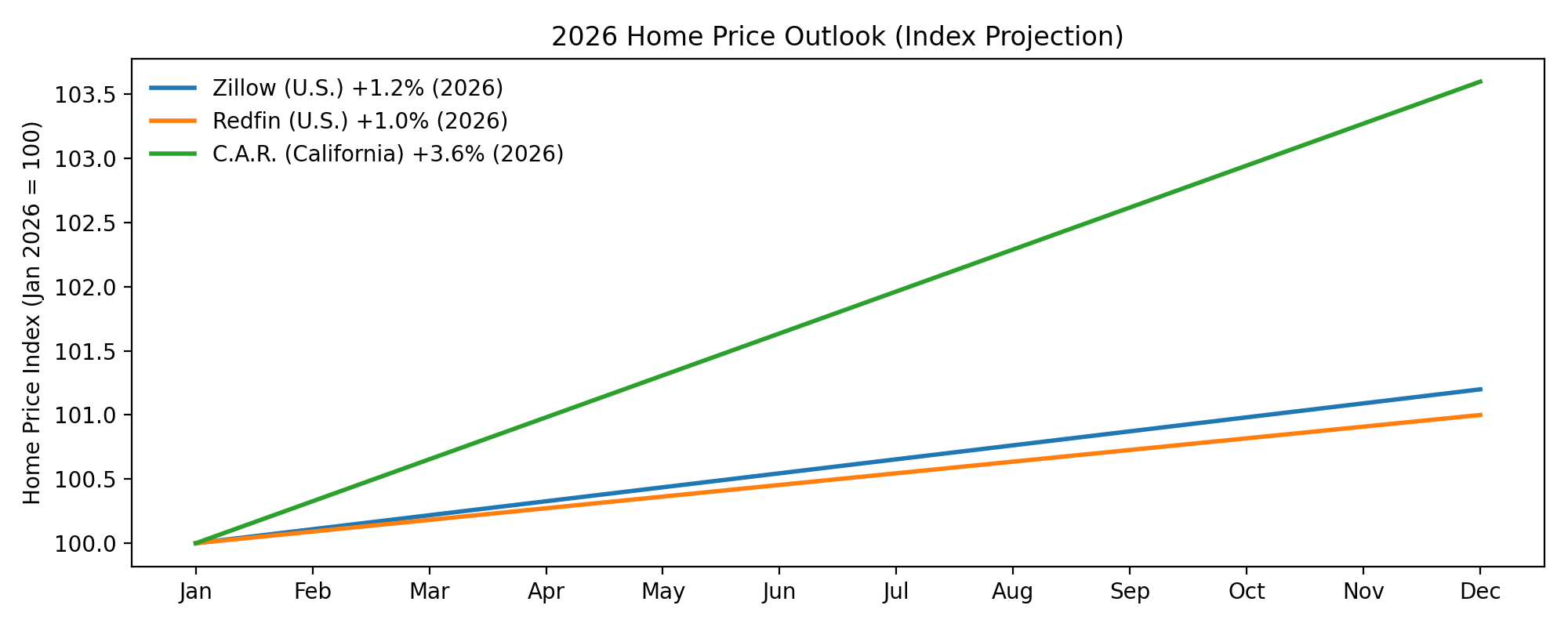

2026 Home Price Outlook — At a Glance

Want neighborhood-specific numbers? Text George at 619-846-1244.

|

A quick note as the year wraps up

As Christmas approaches, many San Diego homeowners and buyers are quietly thinking about what’s next. I’m grateful for the conversations and trust this year — even when it’s just to get clear, honest answers.

If a move might be on your radar in the next few months, here are a few things I can help with that aren’t easy to find online:

- Off-market & unlisted homes

- Real cash-offer comparisons (actual net numbers)

- Buy-before-you-sell options

- Homes with assumable low-rate loans

- A clear timing & pricing reality check

No pressure. If this would help, just text or call 619-846-1244.

P.S. Buying, selling, or just planning — even a short text like “We’re thinking about a move” is enough to start.

|

What 2026 Predictions Mean in Real Dollars

Forecasts are helpful — but what matters most is how they apply to a home like yours. Here are simple examples using today’s typical San Diego price points.

Detached Home — $1,000,000 Example

- Zillow (+1–2%): $1,010,000 – $1,020,000

- Redfin (0–3%): $1,000,000 – $1,030,000

- C.A.R. (+3–5%): $1,030,000 – $1,050,000

Condo / Townhome — $650,000 Example

- Zillow (+1–2%): $656,500 – $663,000

- Redfin (0–3%): $650,000 – $669,500

- C.A.R. (+3–5%): $669,500 – $682,500

If you want this run for your neighborhood and price range, text me at 619-846-1244.

|

Bottom Line for 2026 (San Diego)

Most forecasts point to modest price movement and a market that rewards the basics: pricing, condition, and location. Well-located homes still attract buyers, while overpriced or problem listings sit.

Condos often become more negotiable when rates are higher; detached homes tend to hold value better over time. The winning strategy is not guessing the future — it’s making the right moves for the market you’re in.

|

Want the short version that applies to you (not the internet)? Text me your situation + timeline and I’ll reply with real numbers.

Call / Text 619-846-1244

|

George Lorimer • ProWest Properties • DRE #01146839

Your Home Sold Guaranteed or I’ll Buy It!* *conditions apply |

|